Introduction

In the world of contracting, whether it be construction, electrical work, or general home improvement, one term that frequently arises is "bonding." Many contractors may find themselves pondering the question: Is it truly necessary to be bonded? While some may consider it just another bureaucratic hurdle, the legal implications of not being bonded can have far-reaching consequences. In this article, we will explore the intricacies of bonding in detail and explain why understanding the legal implications of not being bonded as a contractor is crucial for anyone in the industry.

What Does It Mean to Be Bonded?

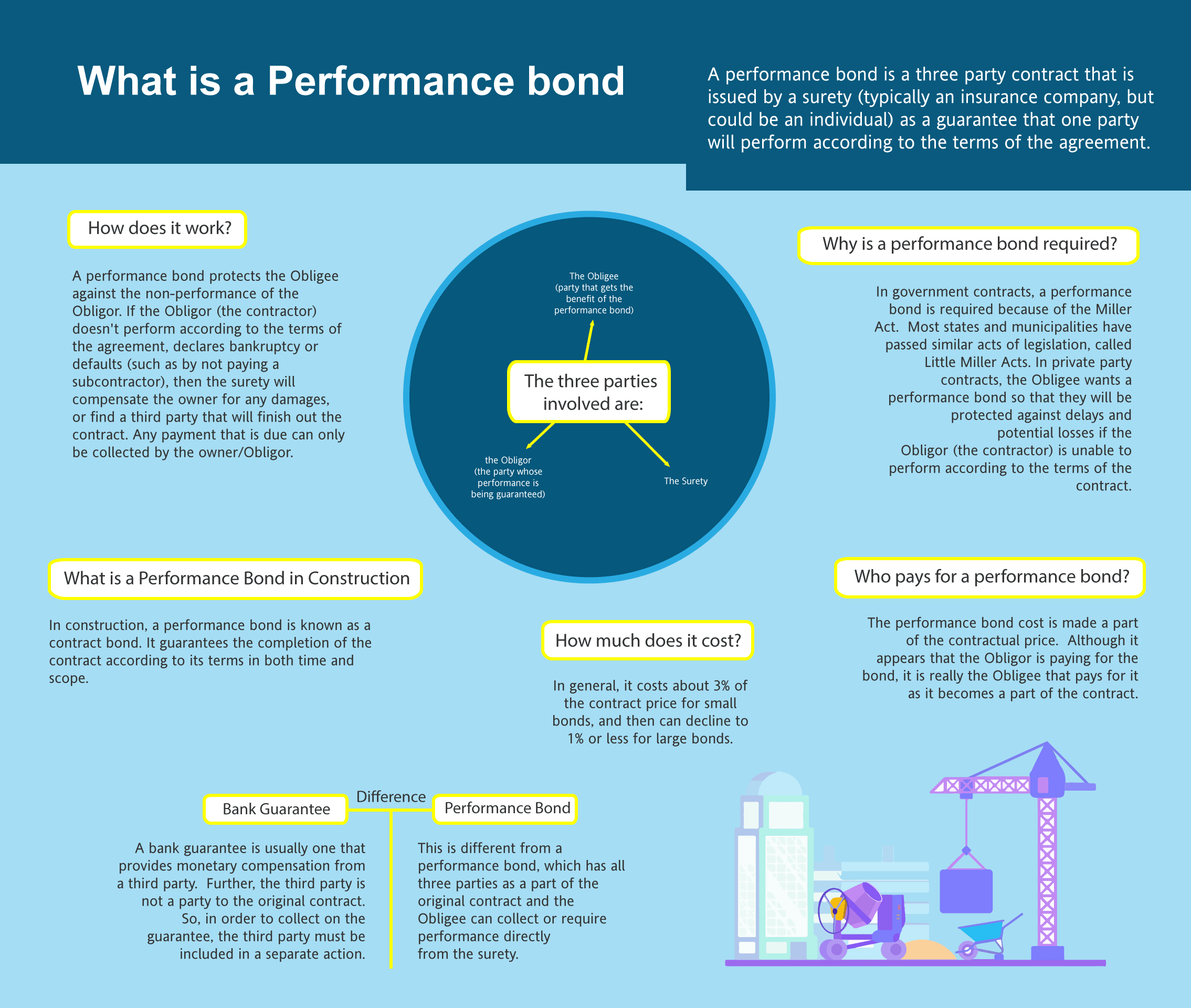

To be bonded refers to a contractual agreement between a contractor and a surety company. This bond essentially serves as a guarantee that the contractor will fulfill their obligations under a specified contract. If they fail to do so—whether due to poor workmanship, financial issues, or any other reason—the surety company steps in to compensate the affected parties.

Types of Bonds Available for Contractors

- Bid Bonds: Protects project owners during bidding. Performance Bonds: Ensures completion according to contract terms. Payment Bonds: Guarantees payment to subcontractors and suppliers.

Understanding these various types can help contractors navigate their obligations more effectively.

Why You Should Consider Being Bonded

Being bonded offers various benefits that extend beyond legal compliance. Here are several reasons why contractors should consider becoming bonded:

1. Enhanced Credibility

When contractors are bonded, it serves as evidence of their reliability and professionalism, giving potential clients peace of mind.

2. Competitive Edge

In many cases, clients prefer hiring bonded contractors over non-bonded ones. It can be a deciding factor in winning contracts.

3. Customer Protection

Bonding protects clients against financial loss due to incomplete or defective work.

The Legal Implications of Not Being Bonded as a Contractor

So what happens if you choose not to be bonded? The legal ramifications can be significant and varied depending on your location and the type of work you're involved in.

1. Increased Liability Risks

Without bonding, contractors take on all liability risks themselves. If an issue arises—such as financial failure or inadequate work—clients have limited recourse for compensation.

2. Difficulty in Securing Contracts

Many public sector projects require bonding by law. Without it, you will automatically disqualify yourself from bidding on these lucrative opportunities.

3. Potential Legal Action

Clients may pursue legal action for damages if they experience issues with unbonded contractors’ work. This could lead to costly litigation that ultimately harms your business reputation.

State Regulations Regarding Bonding

Each state has specific regulations concerning contractor bonding requirements. Understanding these regulations is essential for compliance and successful business operation.

1. Licensing Requirements

Some states mandate that certain types of contractors must be bonded before they can obtain licenses or permits.

2. Penalties for Non-Compliance

Failing to comply with bonding regulations can result in fines and even loss of license.

Essential Steps for Becoming Bonded

If you're convinced about the necessity of being bonded, here are critical steps you should take:

Step 1: Research Surety Companies

Look into various surety companies that offer bonding services tailored for your https://sites.google.com/view/swiftbond/surety-bonds/documentation-required-compliance-with-safety-regulations-for-bond-release trade or profession.

Step 2: Assess Your Financial Standing

Surety companies will evaluate your credit score and financial history before approving you for bonding; ensure you’re in good standing.

Cost Factors Associated With Bonding

Being bonded isn't free; you'll incur costs depending on various elements including:

| Cost Factor | Description | |---------------------------|----------------------------------------------------| | Credit Score | Higher scores usually mean lower premiums | | Contract Size | Larger projects often necessitate higher bond amounts | | Business History | Established businesses might pay less than startups |

Understanding these costs helps prepare your budget effectively.

Frequently Asked Questions (FAQs)

Q1: What is a surety bond?

A surety bond is a three-party agreement between the principal (contractor), obligee (client), and surety (bond company) guaranteeing performance or payment obligations.

Q2: Can I get bonded with poor credit?

While challenging, it’s possible! Some sureties specialize in high-risk bonds but expect higher premiums due to increased risk factors associated with low credit scores.

Q3: How long does it take to get bonded?

The process typically takes anywhere from a few days up to several weeks depending on your business's complexity and documentation readiness.

Q4: What happens if I default on my bond?

If you default, the surety company will cover claims against your bond up to its limit but will seek reimbursement from you afterwards—a costly mistake!

Q5: Are there alternatives to being bonded?

Yes! However, alternatives like insurance don’t provide the same level of protection for clients as bonds do when it comes to project completion and payment guarantees.

Q6: Do all contractors need to be bonded?

Not all; however, many governmental contracts require bonding as part of their stipulations which makes it advisable for most professionals in construction-related fields anyway!

Conclusion

Navigating the complexities surrounding bonding can seem overwhelming at first glance but understanding its importance is crucial for any contractor aiming for long-term success. The legal implications of not being bonded as a contractor can jeopardize both your professional credibility and financial stability while limiting your access to essential contracts within your field.

Ultimately, investing time and resources into securing proper bonding could save you countless headaches down the road—not only protecting yourself legally but also enhancing client relationships through proven reliability and trustworthiness in an ever-competitive marketplace. So ask yourself—can you afford not to be bonded?

In summary, being aware of the legal implications of not being bonded as a contractor can set you apart from competitors while ensuring you surety bonds provide top-notch service without unnecessary risks hanging over your head like dark clouds!